Ever since Bain & Company developed the Net Promoter Score (NPS) back in 2003, companies have used it to measure customer loyalty and gather qualitative data to improve retention.

NPS gives you valuable feedback on what your customers really think about your product – the pros, the cons, the lovers, and the haters. But, it's not as simple as just emailing out a survey to your customer base.

In B2B SaaS, getting direct, contextual feedback and understanding customer sentiment towards your product will save hours of research, and help you to know whether you're steering the product in the right direction or need to pivot.

NPS is a time-tested method. But how can you be sure you're seeing significant response rates and analyzing the data effectively?

You're probably already familiar with NPS – what it is, how it’s implemented, and why. So this is not going to be a bare-bones guide about everything NPS-related. Of course, we’ll cover the basics, but in this guide, we’ve also compiled every NPS best practice so you can get better response rates and leverage the feedback data.

Specifically, we talk about breaking down the different Net Promoter Score survey distribution channels and understanding the processes behind NPS feedback analysis.

NPS stands for Net Promoter Score, and it’s a type of user feedback that measures the user’s loyalty to the product.

It also gives you signals and predictability about churn, customer retention, and revenue. That’s why you need to conduct NPS surveys continuously to keep an eye on the pulse of customer satisfaction.

Typically, the most relevant NPS question to ask is: “How likely are you to recommend our product to a friend or colleague?”. The answer is measured on a 0-10 scale, and it segments customers into Promoters, Passives, and Detractors based on their answers.

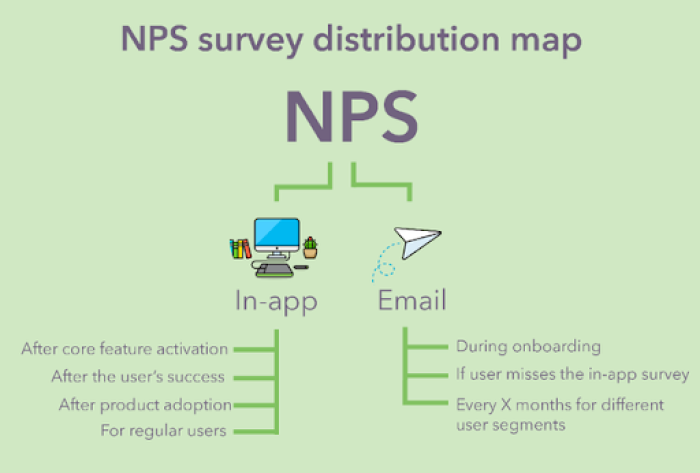

There are two basic channels where can you distribute NPS surveys: transactional emails and inside your product. In-app surveys tend to have better engagement and reach since they are event-triggered, behavior-driven, and delivered in context.

What exactly to do for the best survey results? Some of the NPS survey best practices include customizing your NPS survey, sending the survey to the right number of customers, and using the NPS survey at the right stages of a user journey.

Once you start running your NPS surveys, you’ll be able to collect both quantitative and qualitative user feedback. Below, we go deeper into a 5-step process of how to analyze your NPS data.

Remember, it’s hard to achieve an NPS greater than 60. Studies show that the average NPS score of B2B SaaS companies is in the 40-50 range. Everything above that is considered to be great.

What NPS is and how to calculate it

NPS stands for Net Promoter Score, and it’s a type of user feedback that measures the user’s loyalty to the product.

Typically, there are two NPS questions that Product and Customer Success managers ask their users:

How likely are you to recommend our product to a friend or colleague?

What is the most important reason for your score?

The first question is always measured on a scale from 0 to 10, and it’s used to segment users into different groups based on their answers.

The second question is a follow-up to get freeform feedback on customers’ high or low scores.

Based on the answers to the first question, your customers are divided into three different segments.

Detractors: Customers who responded with 0-6. Detractors are customers who will usually churn and spread the negative word about your product.

Passives: Customers who responded with 7-8. This segment is satisfied enough with your product to use it. Usually, they will not churn, but they will also not promote it.

Promoters: Customers who responded with 9-10. These folks are more than satisfied with your product, and they will be extremely happy to spread the word about it.

Net Promoter Score is calculated when you discard the Passives and subtract the percentage of Detractors from the percentage of Promoters. A company’s NPS score can be from -100 to 100.

And the formula looks like this...

For example, let’s say you have:

30% Detractors

20% Passives

50% Promoters

In this case, it means your Net Promoter Score would be 50% - 30% = 20.

Now, you may wonder what a good NPS score is. It will, of course, depend on your industry and other factors.

In B2B SaaS, according to Retently, it’s very hard to achieve an NPS greater than 60. Based on the research they conducted back in 2018, with more than 60 SaaS vendors, the results showed that Salesforce had the best results with an NPS of 66. The average NPS score of B2B SaaS companies is in the 40-50 range. Everything above that is considered to be great.

And, if you allow us a little bit of bragging, our latest Benchmark Report shows that 50% of our customers’ products have been rated 10/10, and 80% of respondents are Promoters. To learn more about NPS benchmarks, and all the ways you can use in-product experiences to collect customer feedback and scale your self-serve support, download the full Benchmark Report.

Download the In-Product Experiences Benchmark Report

Improve your in-app messaging and scale self-serve success with data and insights from 300 million user interactions with Chameleon Experiences. We'll send the Report to your inbox!

Why is useful to conduct NPS continuously?

Net Promoter Score doesn’t just measure user loyalty and provide you with valuable feedback – it also gives you signals and predictability about churn, customer retention, and revenue.

Furthermore, NPS is directly correlated with growth. As the research from Bain & Company shows:

“In most industries, Net Promoter Scores explained roughly 20% to 60% of the variation in organic growth rates among competitors. On average, an industry’s Net Promoter leader outgrew its competitors by a factor greater than two times.”

– Bain & Company research findings

According to Patrick Campbell, Founder and CEO of ProfitWell, one of the main factors that go into predicting a startup’s future growth is retention. As he explained in his video presentation at the 2019 ProductLed Summit, it is now more important than ever to fight bad retention.

In a nutshell, as Patrick Campbell points out, that’s mainly because:

The market is no longer our friend – there are hundreds of new startups popping up every day.

Customer Acquisition Cost (CAC) is increasing dramatically: In the last five years, it increased by more than 60%. For example, if five years ago you needed $1000 to acquire a new customer, today you'd need $1600.

Consumer Willingness to Pay (WTP) and customer happiness have declined over time: By ProfitWell, WTP declined from 110% to 30% in the last four years. While the average NPS was 33.8 five years ago, it's now just 10.2.

That said, fighting bad retention isn’t just better, but also cheaper.

These are also the reasons why implementing NPS into your customer experience flow and using some of the NPS survey best practices we’ll mention below are tactics you should certainly consider.

Why is it useful and important to consistently conduct NPS surveys to your user base? In short, it helps you to segment your users and increase customer satisfaction rates.

Naturally, getting NPS responses from users will segment them into three different groups. This helps you determine who exactly is interested in your product and who isn’t.

Based on this categorization, you can later:

Find out what types of user personas usually respond with 9-10 or 0-6

Diagnose common problems with particular user personas

Reveal user goals and product expectations

On the other hand, identifying Detractors, Passives, and Promoters helps you to allocate high-touch resources where they need them most.

Based on the groups and segments you later create, you can determine what campaigns for which groups of users could be implemented or you can brainstorm potential strategies about converting Detractors and Passives into Promoters.

For example, you could:

Convert Promoters to brand ambassadors

Educate Passives so they can become product fans

Learn valuable feedback from Detractors

You can create various Microsurveys to prime users for NPS surveys and collect feedback straight from your product or an app.

On-Demand Webinar: How to Use Microsurveys

Equip your team with a modern approach to user feedback that powers product development ⚡

NPS surveys help you find room for improvement

NPS isn’t only about numbers. One of the best parts about the NPS survey is its ability to capture valuable freeform feedback.

For example, you can find out what makes Promoters so loyal and satisfied, or, you can learn why Detractors don’t like your product and their common problems and pain points.

Collecting qualitative feedback is why most surveys ask a follow-up question: “What is the most important reason for your score?”.

Without a doubt, you might face a percentage of spammy or irrelevant answers. But, that extra question helps you to identify serious customers.

NPS measures customer loyalty

Understanding customer loyalty to your brand is very important. Bain & Company find out that, depending on the industry, an increase of 5% in retention can result in a 25-95% growth in revenue.

This directly correlates with loyalty.

There are numerous use cases of how the NPS score can help you improve customer loyalty and boost retention and promotion of your product. For that reason, it’s important to know who exactly is willing to promote your product (and everything about it).

For example, you can ask Promoters to tweet about the latest article you wrote. Or, on the other hand, you can convert them to be affiliates, and give them 15% of each subscription that came from them.

Changes in NPS can be a positive indicator – or a warning. Make sure to use your NPS data to always improve your product and deliver a better customer experience.

NPS can be used as a referral marketing channel

According to Temkin Group’s research conducted back in 2017, Promoters are 4.2 times more likely to purchase from you again, 5.6 times more likely to forgive you for your mistakes, and 7.2 more likely to try a new feature, product, or any other kind of offer compared with the Detractors. This makes Promoters ideal for:

Testing your new ideas and features (adding them to beta groups)

Asking them to promote your product, content, or new releases

In other words, NPS measures the likelihood of gaining word-of-mouth marketing from your users.

Leveraging this, NPS is one of the best-rated ways to boost your referral marketing and identify people who are willing to recommend you. Many will do it organically and for free, but some could be incentivized further with affiliate links and bonuses, like Trello's Gold program or Dropbox's famous viral loop.

Before we start explaining how to implement your NPS survey, let’s check some generally-important best practices for NPS surveys.

NPS survey distribution – where and when to reach out to your users

There are two basic channels where can you distribute NPS surveys:

Transactional emails

Inside your product

It’s very simple why these two channels are the best fit for the NPS survey. Both of them are triggered in some contextual way.

Transactional emails are by nature triggered by an in-product event or a date. NPS through email can gather less feedback, but the experience is less frictional and intrusive since it doesn’t interrupt someone’s work.

On the other hand, in-app surveys tend to have better engagement and reach since they are event-triggered, behavior-driven, and delivered in context. That’s exactly what one of our customers, Reid Givens, Growth Manager at ClockShark, found out: “In-product prompts drive far more engagement than emails”.

Timing and frequency of distributing NPS surveys

Pay close attention to the timing and context of your NPS survey cadences. It's common to see products polling for NPS at every step of the user journey, but it doesn't work like that.

An NPS survey should be triggered by some in-app experience. For example, you can ask your customers for their NPS feedback once they activate some particular feature or after you celebrate the successful completion of a task.

In any case, there are no hard-and-fast timing and frequencies; it all depends on your strategies and goals, but there are some general rules you should follow:

Don’t send the survey too early: Don’t force your new customers to rate their loyalty right away. Give them time to breathe, explore your product and achieve results. At the end of the day, why would the feedback be relevant if you ask for it right away? One of the best moments to reach out to your users is after they activate important features, gain some success with your product, or fully adopt it.

Pay attention to the context: As we mentioned above, context plays a significant role in the NPS survey distribution. The best time to show NPS surveys is after your customers feel something great inside your product. Whether it’s creating an order, sending the first outreach campaign, or in our case – creating the first in-product experiences!

Ask for NPS feedback more than once, but don't overdo it: Detractors can suddenly become Passives, Passives can become either Detractors or Promoters, and Promoters can easily disengage. Things change as your product and market evolve. If you don’t ask for NPS at reasonably regular intervals, you will miss the opportunity to engage with customers based on the changes in their sentiment and new experiences. One of the best practices is to survey your users every 2-4 months.

Send your NPS survey at the right time: If you’re surveying your customers through email, it’s of crucial significance to send your emails at the right time. According to Smart Insights, 23.63% of all emails are opened within the first hour of delivery, 4.8% in the fourth hour, and 0.63% in the 24th hour. Remember that your NPS email is competing with both personal, business, and spam emails. According to CoSchedule, the best days to send your emails are Tuesday, Thursday, and Wednesday at 10 am or 2 pm.

Notify users first, then survey: A Retently study shows that pre-notifying your users can improve your response rates from 4-29%.

NPS survey best practices – what exactly to do for great results

Like we mentioned at the beginning, this is not an ordinary “guide” that aims to teach you about how to create NPS or why it’s important to use it.

Our goals here are to present you with NPS survey best practices and examples to help you to make the most out of your NPS campaigns, learn valuable feedback, satisfy your customers and eventually improve retention and revenue.

So, here are the NPS survey best practices that our team has learned over the years.

Customize your NPS survey

Since the response rate of surveys is never 100%, lowering the friction of the process is a must for a successful campaign.

Make sure to customize the colors, fonts, and text sizes of your NPS survey, so it appears to be part of your product. Try to use a contrasting or eye-catching color so the survey doesn’t blend into your app and get ignored.

Make sure that your NPS survey templates represent your brand, message, and use cases in the right way. Besides design, however, you should also pay attention to the text itself. Make sure that your NPS survey correlates with your target audience.

Here’s a simple visual that we’ve created so you can find out the winning text for your NPS survey based on your target audience.

Send NPS survey to the right number of customers

If you want statistically significant results, you will need to determine what would be the ideal number of users who will see the NPS survey – especially if you’re doing it in bulk – without any context.

If you’re planning to create context-driven NPS surveys, the good thing is that you won’t need to think about this part. Especially because, eventually, a large enough group of people will pass through the same user onboarding process and see your NPS survey.

If you’re sending in bulk (for example, if you want to survey customers who are with you for over two years now), then be sure that you have enough people to question.

Both very small and very large groups can give you statistically wrong data, so keep this in mind when choosing the audience segment you want to collect the feedback from.

Use NPS survey at the right stages of a user journey

The best way to send your NPS survey is to trigger them by some in-app experiences, actions, or user behaviors. For that reason, user onboarding and other milestones need to interact smoothly with each other, not clash.

One of NPS best practice for in-app is to ask for feedback after important product milestones, such as:

The moment when your customers completely adopt the product: This is the moment when your customers activated all features and started to use your product regularly.

After you celebrate success: Depending on your product use cases, the term “success” can have different meanings. For example, for CRMs, it can be sending the first email campaign. For email finding tools, it can be finding the 10th email address.

Unique date-set: NPS surveys don’t necessarily need to be triggered by in-app actions. They can also be triggered according to the time your user spent in the product. For example, you can schedule your NPS survey to be sent 10 days after your customers start using your product or two days before the trial expires.

Send NPS surveys both in-app and through transactional emails

You can choose to send your NPS surveys either through an app or via transactional emails. Or, sometimes, the best option could be sending through both places at the relatively same time.

Here’s what our team found very useful to boost engagement and response rate.

Show your NPS survey in-app after some important experience. If the customer responds – great! If not, send them the NPS survey again – one day later – but via email.

With this, there are fewer chances for customers to skip or don’t notice the NPS survey.

A/B test your NPS survey

A/B testing is always a good thing to do. If you’re sending your NPS survey through email, keep in mind that the average email open rate is 25%. That means that only a quarter of your customers will see the survey. To make matters even worse, not all of them will bother answering it. To improve your email open rates, try testing out different subject lines.

If you’re sending your NPS survey in-product, then play a little bit with different color schemes and UI elements. Also, test different versions of questions and copy you use for statements. See what type of NPS survey gives you the best results, and focus on that.

Make NPS surveys more personalized

Recently, personalization has started to take its place in every aspect of sales and marketing. It's no different with NPS. Research from Linkdex shows that more than 79% of customers are expecting the brand to know them very well and deliver tailored and personalized experiences.

So, next time when you’re sending your NPS campaign, try to input the first name of your respondent, and perhaps the company name.

Offer an incentive to your respondents

As a general rule of thumb, incentives should be ignored for questionaries and surveys since they can bring inaccurate data.

Yet, if your responses and open rates are too low, and other strategies don’t work, try to offer one to your customers. That could be something as little as an eBook, checklist, or even one day of free credits.

Now that you're familiar with NPS survey best practices, let’s see how to analyze the data you'll get.

How to analyze your NPS data

NPS analysis is as crucial as data collection. If you don’t analyze and interpret your data effectively, then you won’t have much benefit from it.

Let’s look at a 5-step best practice for NPS data analysis.

1. See which engagement metrics define your customers

You should correlate your Detractors, Passives, and Promoters with engagement metrics that showcase:

The number of logged sessions

Most visited pages

In-app behaviors

The average sessions

Click-through rates

Average time in your product

Any other important product KPIs

Just imagine the following situation.

If you could find out common events and paths associated with Promoters, you can try to re-engineer the product experience and make these key features and actions more attractive for passives and detractors.

For example, if Promoters visit a particular feature often, deploy a prompt that directs, markets, and educates to this segment. You might find it’s uncorrelated, but running product experiments will always produce more insight than inaction.

Understanding the behavior of all Detractors, Passives, and Promoters will help you identify positive and negative trends and improve your in-app experiences, build more effective product tours, and streamline user onboarding based on that.

2. Use all your data to interpret qualitative research

All SaaS businesses, whether B2C or B2B, collect some data about users.

For example, high-touch SaaS businesses with bigger average revenue per user (ARPU) have a tendency to collect more data about their customers, while low-touch businesses don’t (tools like Heap can break the engineering bottleneck for companies by auto-collecting every event and property regardless).

Data collected usually depends on the friction of your signup flow. Low-touch businesses are usually collecting only the name and email, while the high-touch B2B SaaS companies are asking for the industry, company size, title, team size, and other information because qualification is important for efficient sales.

In any case, a good practice is to pull out insight from your NPS research that correlates with your user's relevant properties. Tools like Clearbit can be used to enrich user profiles and give you deeper segmentation and insight, like company size, industry, and more.

With that, you can find out what type of customers have a tendency to be most (or least) loyal to your brand.

The other types of data you can correlate with your NPS attributes are:

Demographic (i.e. age or location).

Behavioral (i.e. actions users take in your product, time spent in the product, etc.)

3. Perform the verbatim analysis

An answer to “How likely are you from 1 to 10 to recommend our business to your friend?” will not give you feedback on how to improve your business alone.

That’s the reason why you should also analyze responses to the second part of the survey and the follow-up question: “What’s the most important reason for your score?".

Answers to this question are called verbatims.

The best way to analyze this type of question is to tag responses that have certain things in common like they reference a specific feature or flow (#onboarding-tour, #export-feature, or similar).

Because there can be various answers with the same context, adding tags will help you to conduct better analysis.

Here’s an example of three different (but also the same) answers:

Sometimes I need a lot of time to find some particular function inside your product.

I have trouble with using your product.

The product is a little bit confusing.

All of those answers could be categorized as a need for a better user experience.

The verbatim analysis will help you to easily analyze the reasons behind the customer’s scores and get the ultimate feedback on what you are doing great and what you need to improve.

4. Read every comment

Although this can be a little bit time-consuming, RunOurSurvey found out that 1 in every 1000 comments can be a great innovation opportunity.

Try to instruct certain teams to regularly go through the comments. This is usually what the Customer Success team will do.

On the other hand, you can also try to feed your NPS survey responses into Slack or any other communication channel you’re using, either with a direct integration or by using a tool like Zapier.

5. Identify the root causes of customer’s feedback

One of the key indicators of your company’s performance is the root cause of the customer’s feedback.

The best way to identify the root causes is to follow your verbatims in different periods of time (for example, to follow your verbatims during the 10 NPS surveys in 20 months).

Make sure that you have enough data collected over several different time periods.

Pro Tip: Also pay attention to the number of surveyed customers. The best tactic is to focus on no less than 500 users.

A general rule is to not use between 500 and 1000 verbatims by the time period and make sure that your verbatims are the same along the way. Using too many different verbatims will confuse you while changing your verbatims, and it might lead to incorrect data.

After you pass several time periods, you can try to run a frequency analysis in a table sheet to see which verbatims are used the most, and what the root causes of customer satisfaction or dissatisfaction are.

The bottom line

The NPS survey is one of the best ways to determine your customer’s loyalty to your brand, collect valuable feedback, and predict churn and retention.

In this article, we’ve covered NPS best practices to achieve better results, gain better engagement, and improve your survey engagement rates.

Now that you know everything you need to create an effective NPS feedback collection, it’s time to take action.

Do users love your product?

Deploy a feedback survey in minutes and find out!