Retention is a competitive advantage and key differentiator for companies that operate the subscription-based pricing model. With the multiple and frequent touchpoints in a typical SaaS customer lifecycle, it would be hard to break even and find growth if users don’t stick around your product, find value, and become promoters.

Moreover, it’s 5x cheaper to retain a customer than it is to gain a new one. And boosting customer retention by 5% increases profits by up to 95%.

In SaaS, retention is a key metric that measures the percentage of customers you retain over a period and shows both current and future revenue. Ideally, a high retention rate indicates a low churn rate.

When users churn before completing adequate payment cycles in their lifetime, it becomes hard to achieve an ideal ratio between the customer acquisition cost and customer lifetime value.

However, when customers become advocates, net promoters, or loyalists, it’s easier to ask for more dollars from existing ones and gain new customers at the same time.

According to Profitwell’s study on 512 SaaS companies, when considering the same level of impact for each growth lever, retention and monetization yield more revenue impact than acquisition.

Customer Retention is a key metric for SaaS. High retention indicates a low churn rate and is an important indicator of current and future revenue.

While a report shows that a customer retention rate of 35% and above (measure over eight weeks) is great for SaaS, it’s best not to focus on benchmarks as products are unique.

Besides measuring your customer retention rate, keeping up with other retention metrics like churn, NPS, and CAC that impact revenue and growth is essential.

What is customer retention?

Customer retention involves all the strategies, actions, and activities that a company employs to reduce churn and retain customers over a certain period. When it comes to the subscription model, retention begins from the first contact with a customer, when they find the "aha moment", and spans throughout the lifetime with your product.

Customer retention is a quick and effective way to boost revenue since you’re selling to existing customers who have an established relationship with your product. In other words, you don’t have to burn cash on the “attract, educate, and convert” acquisition loop. Customer retention is also an indicator of customer loyalty.

How do you measure customer retention?

Customer retention rate is the percentage of customers who continue to use your product over time. These are customers who were active subscribers in a given period and still resubscribed in the next period.

Customer retention rate = (Number of active customers that continue their subscription in a given period / total number of active customers at the beginning of that period) × 100

What is a good customer retention rate?

According to a Mixpanel report, a customer retention rate of 35% and above (measured over eight weeks) is great for the SaaS industry.

However, it’s not advisable to focus on retention benchmarks because no two low-touch or high-touch SaaS companies would have the same goals, customer journey, pricing model, sales process, and/or even target market.

Depending on average contract value and other factors, some SaaS companies may need only 50 new customers annually, while others may need as much as 5000.

What are the 5 key metrics to measure customer loyalty and retention?

Rather than tracking metrics that have no impact on your overall business health, the customer retention metrics which have the biggest impact on growth are able to show you the customers that are churning, when they’re churning, and the reason why.

Although there are other metrics that may directly and/or indirectly influence SaaS retention, we’ll talk about the five key retention metrics that have a huge impact on revenue and growth.

1. Customer Churn

Customer churn measures the number of customers or subscribers who stopped using your service in a given period. A customer churn rate of 10% MoM implies that 10% of the total subscribers from 30 days ago have unsubscribed within the last 30 days.

The easiest way to understand and reduce customer churn is to see it as the factor that causes leakage points for your recurring revenue to drain. If you’re able to see it this way, you’ll agree that it doesn’t make much sense to keep acquiring customers that will churn the usual way.

Rather, it’s wiser and cheaper to implement strategies that will help to retain existing customers, before acquiring new ones. Moreover, the higher the customer churn, the slower the growth. Also, churned customers are a goldmine of insights that can help you serve the existing ones better.

By understanding why customers leave, when they leave, and how they leave, you’ll be able to predict churn and optimize the customer experience for the ones who are still subscribers so they don’t churn. This way, you can keep both churn and retention rates in check.

Reduce product cancellations: get the webinar recording and slides

Learn how great products like Zoom and Harvest deflect cancellations 📈

2. MRR Churn

MRR churn poses a direct threat to your monthly recurring revenue (MRR). It measures how much MRR was lost due to customer cancellations in a given period. An MRR churn rate of 10% implies that 10% of your MRR from 30 days ago was lost within the last 30 days.

Even for SaaS companies that have different pricing tiers and contract terms, MRR churn is still a great metric to measure business health. Customer churn only shows you the number of cancellations. But MRR churn shows you how much revenue was lost and the overall impact. And the lower the MRR churn, the faster the growth.

3. Customer Lifetime Value (LTV)

Customer lifetime value is an estimate of the amount a customer will spend on your service throughout their lifetime as a paying customer. This metric shows the value of every customer and the revenue you can generate if customers are retained and continue to pay.

Moreover, your existing customers are capable of spending 67% more on average than new ones.

In SaaS where you have varying pricing tiers, different customers can have different customer lifetime values. So, it’s recommended to calculate LTV for customers based on the pricing tier they are subscribed to. Nonetheless, you can simply calculate lifetime value by dividing your average monthly revenue from each customer by your churn rate.

If a customer pays $2,000 per month, and you have a churn rate of 5%, your lifetime value for a new customer is $40,000 through an expected period of 20 months. It's no wonder, 76% of companies place critical importance on customer lifetime value as a concept.

Lifetime value is also a valuable metric when you measure it alongside another important metric like customer acquisition cost (CAC).

4. Customer Acquisition Cost (CAC)

Customer acquisition cost refers to the resources and costs that are needed to acquire a new customer. This includes advertising and marketing spend, subscription for tools, salaries, bonuses and commissions, and other overhead costs.

It is the total cost of acquiring new customers divided by the number of newly acquired customers.

CAC is a fundamental metric that helps you to understand your target market and the ROI of your existing acquisition strategies and channels. When you analyze CAC alongside other metrics such as customer lifetime value, you’re able to evaluate the scalability and profitability of your SaaS company.

For example, if the average customer is paying $5,000 over a given period (lifetime value), spending $4,000 on acquisition (CAC) isn’t a sustainable option.

Ideally, the lifetime value (LTV)-customer acquisition cost (CAC) ratio should be 3:1. This implies that a customer should bring 3x as much as you spend on acquisition. If a customer is paying $5,000 over a given period of time, you should be spending $1500 or less to acquire that customer.

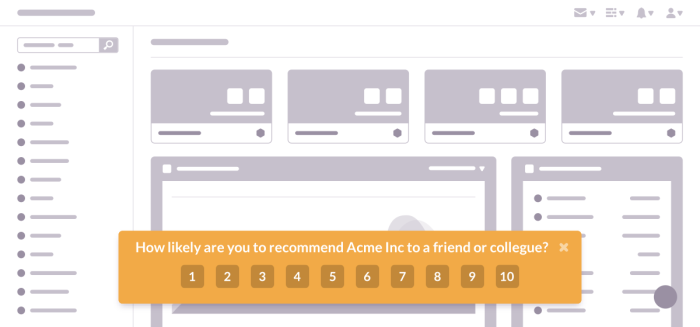

5. Net Promoter Score (NPS)

Net Promoter Score is a customer satisfaction key metric that measures the general satisfaction of your customers and their willingness to refer your product or service to others. It measures how satisfied customers are with your product, how loyal they are, and how likely they are to recommend your product.

This index can be used to gauge customer loyalty by collecting feedback in a Microsurvey with a numerical scale that respondents can answer using a 0-10 scale.

Detractors are customers who are in the 0-6 range and unhappy with your product. It’s possible they have failed to find value in your product and are at the risk of churning.

Customers in the 7-8 range are known as the “passives” and those in the 9-10 range are the “promoters” who love your product and don't mind sharing with others.

Although the response rate of an average survey is a little over 3%, NPS surveys are so easy to fill that they have up to 20%-40% response rates.

An NPS that score that is:

Under 0 is extremely worrying, what has gone so wrong?

Between 0-40 is a cause for concern—some users do like you, but the majority aren't smiling

Between 40-60 is okay—you can pick this up by asking for constant feedback to improve

Above 60 is excellent—but you can always get better 😉

However, a high NPS doesn’t automatically guarantee customer retention and growth. But when analyzed alongside revenue growth rate and customer churn rate, you can predict possible growth from retention and referrals.

Make your NPS surveys count

Get highly relevant feedback by using Chameleon to send your surveys in-app

Final thoughts on key metrics

When you talk about SaaS retention and growth, it’s easy to become overwhelmed by the numerous metrics you can possibly track.

So, it’s valuable to discover the metrics that drive conversions, retention, and revenue growth in your company early enough.

With Chameleon, you can boost retention and revenue rates by educating your users on the benefits of your product as they use it—discover why companies choose Chameleon to drive their growth.