Whether you're just starting a SaaS business or you're a veteran product manager, getting feedback from users is a top priority.

Building systems to regularly collect customer feedback will help you achieve success for your product while avoiding presumptions and misconceptions about user experience.

Product surveys and user research are vital for product managers when it comes to gathering valuable data or validating ideas and hypotheses, as well as anticipating customers' expectations .

What's more, honest feedback from properly delivered product surveys can help you illuminate all stages of the user story. Knowing those user insights can help you nurture more loyal customers.

In this article, we show you how to create product surveys with steps, best practices, and question examples so you can get feedback and create products users truly love.

Product surveys are quick surveys to gather user feedback and improve your product's customer experience

There are eight steps to create product surveys:

Know your goals: figure out what you want to learn about your product

Target the right people: don't survey everyone; pick a representative sample

Ask the right questions: mix open open-ended & multiple choice to gather insights

Keep it short & sweet: aim for 10-12 questions to avoid losing user interest

Choose how to ask: use email, web surveys, or in-product microsurveys for context

Publish wisely: respect user privacy and avoid influencing answers

Improve over time: learn from each survey and iterate for better results

Analyze & take action: use insights to improve your product and user experience

What is a Product Survey?

A product survey is a set of questions you deliver to a targeted group of your user base, helping you collect product feedback about your customer experience. Product surveys help you to build a data-centric understanding of your users and help you:

Find out what's working and what isn’t: discover both what your customers love about your product and which areas need improvement

Enhance customer satisfaction: with the feedback from product surveys, you can address specific parts of your product that need improvement

Build customer loyalty: Show customers that you value their opinions

Inform product development decisions: product surveys give you the data you need for data-backed decisions throughout the product development process

How to conduct a product survey in 8 steps

Creating a great product survey is all about building a roadmap for improvement. Here are eight steps to help you get started.

Step 1: Determine research objectives

Before you start drafting survey questions, figure out what you want to find out. What do you need to know about your product or customers? Are you trying to fix a problem, find new ideas, or measure how happy people are?

Why is this important? Knowing what you want to learn helps you ask the right questions and get the answers you need.

Here are some questions to guide you:

What areas of your product do you want user feedback on? (e.g., usability, specific features, overall satisfaction)

Do you want to understand user behavior or opinions? (e.g., how users navigate the product, what features they value most)

Are you trying to identify problems or measure success? (e.g., identify pain points with a new feature, gauge user satisfaction after a recent update)

When you clearly define your goals, you can choose the right survey type (e.g., customer satisfaction survey, usability test) and ask targeted questions that provide valuable insights (more on product survey types later).

Step 2: Find the right target for your sample

Surveying every single customer is impractical and time-consuming, making it difficult to analyze and interpret meaningful conclusions.

Instead, pick a group of people who are most likely to give you helpful information. This could be people who recently bought your product, people who use your product a lot, or people who recently stopped using your product.

Here are some probability methods you can use to set your sample:

Random sampling: select a random subset of participants, giving each user an equal probability of being chosen

Systematic sampling: choose participants at regular intervals. For example, pick every 10th person on your customer list.

Stratified sampling: divide your audience into groups (like age or location) and then randomly select from each group. This ensures you get feedback from different segments of your customers.

Clustered sampling: divide your audience into groups (like cities or neighborhoods) and then randomly select whole groups to survey. This is useful when your audience is spread out geographically.

Step 3: Ask the right questions

Depending on the type of survey you're creating (see below for 12 different product survey types), you'll need to ask the right kind of questions.

Some types include:

Open-ended

Close-ended questions

Multiple-choice

Emoji-based questions

Star rating questions

Demographic questions

Preference questions

Emotional state questions

Examples of product feedback survey questions to ask:

How do you feel while using this new feature?

Would you recommend our product to your teammates?

How would you rate our product on a scale from 1 to 10?

Which of the following statements describes you best?

How easy was this step? How long did it take you to complete it?

Step 4: Create the first draft of your product survey

People have short attention spans, 8.25 seconds, to be exact. Keep your survey concise. Aim for a set of questions that takes between five and seven minutes to complete. A longer survey can make people drop out before finishing.

Focus on the most important questions. Prioritize the information you need most and cut out unnecessary questions where you can.

Then, ask yourself the following questions about your survey’s design:

How do you group the questions?

What should users answer at any specific moment?

Does the design match your brand's style?

Is the survey design going to improve user experience?

Where to position your survey and how to present it?

These are only some of the questions to consider, the definitive list will depend on the customer survey type you create.

Step 5: Choose the right user feedback tools for your product surveys

The best user feedback tools will help you create customized, short-form surveys you can place directly within your product. Look for tools that also link survey responses to user data. Such features let you see when and where a user makes a decision within the user journey.

Typically you can send surveys via email or web pages through variety of online survey tools.

However, if you want to run your surveys in-product, you can use a tool that creates product feedback surveys, such as Chameleon, to create and run in-app microsurveys which will help you better understand the user's motivation and capture results that are more accurate.

Microsurveys that are delivered in context like these can better measure customer sentiment, because you'll know what the user has done immediately before answering your survey. This means you can better understand the motivation behind their answer.

Collecting user feedback at that very moment is more useful than surveying users generically about the product because:

General feedback can be vague, with lower response rate

Surveys via non-product channels may fall out of context

Step 6: Publish the product survey

Publish (or perform) the survey respecting your user's anonymity, asking one question at a time and avoiding influencing users' opinion by how you formulate the questions. Keep it short and sweet. Aim for a survey that can be completed in a few minutes. People are busy, so respect their time.

Also, you should always give a way out in case a user doesn't want to answer immediately. You can do this in a user feedback tool by adding a "snooze" option to re-open the survey later on.

Step 7: Iterate and improve the survey

The first product survey you design is not going to be the only one. As in any development, you should iterate and improve based on customer feedback. Remember to include this in your goals, especially if you're just starting a business.

For example, you may have started with a small sample, but you might need more users for your next survey.

Step 8: Collect customer feedback and evaluate the results

Based on the survey results, that become statistics, you'll be able to infer for the rest of your target population. See if they validate or invalidate your hypotheses. Search for common points and brand-new findings.

Then, act upon your insights to iterate your product and improve user experience by addressing customer issues and increasing customer satisfaction scores over time.

12 types you can use for an in-product feedback survey

1. NPS Survey (Net Promoter Score)

An NPS survey determines how likely a user is to recommend your product or service to a friend. This helps measure customer loyalty and identify different customer segments.

During the last decade, NPS has become a popular indicator for future SaaS growth. It's a very simple product marketing tool with many applications. It's also easy to understand for deployers and respondents and also easy to implement.

Methodology

First, you measure the net promoter scores with survey questions. You collate the answers which are on a scale of 0-10, grouped into:

Detractors (0-6)

Passives (7-8)

Promoters (9-10)

In the end, you'll subtract the percentage of promoters from the percentage of detractors.

NPS = (Number of Promoters / Total Responses) – (Number of Detractors / Total Responses)

The NPS survey will completely ignore passive respondents.

In addition, when you perform the customer survey, you'll optionally be asking respondents to justify their answers. This will be of help as it will point out some areas of improvement. You can choose to deploy the survey by email or by using an in-app solution.

2. CES Survey (Customer Effort Score)

The CES (Customer Effort Score) survey is useful to measure the level of effort a client has to make to interact with a company.

For instance, when they want to solve an issue, buy, or return a product. The premise here is that customers will be more engaged if the level of effort the brand requires is lower.

Methodology

The CES survey typically gives multiple-choice answers that will reflect the level of effort a customer had to exert.

Sometimes, the respondents will use a scale that goes from “very easy” to “very difficult”, but you can also see options of emojis or 1-5 scales.

According to the book The Effortless Experience:

“96% of customers with a high-effort service interaction become more disloyal compared to just 9% who have a low-effort experience”.

As a customer survey type, the Customer Effort Score should be always used along with another product survey like NPS, to better measure clients' loyalty.

The CES in-product survey should be sent as soon as specific interactions occur at customer journey touchpoints:

After purchase or subscription

After adding a new feature

After interaction with customer service

If you want to have more information, you can also ask users to justify their answers.

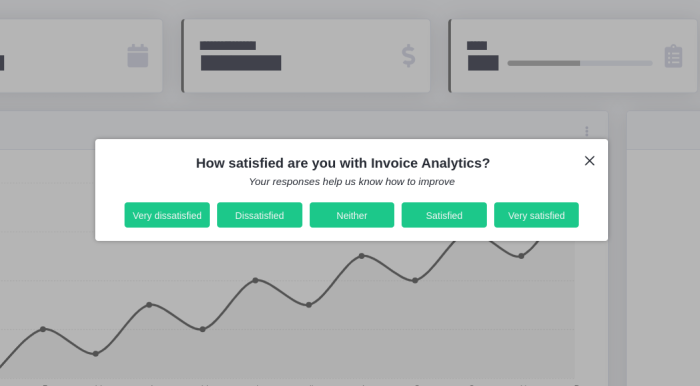

3. CSAT Survey (Customer Satisfaction)

While CSAT's customer satisfaction survey may seem similar to the NPS, it is not. NPS measures the level of satisfaction in general while CSAT only does it for specific experiences.

Methodology

For this Microsurvey, you'll see options of scales from 1 to 5, emoji, or even phrases. You should keep it as simple as possible. The five choices measure customer satisfaction at different levels:

Very unsatisfied (1)

Unsatisfied (2)

Neutral (3)

Satisfied (4)

Very satisfied (5)

To figure out the results you'll have to calculate the following formula:

(Number of satisfied customers (4 and 5) / Number of survey responses) x 100 = % of satisfied customer

The timing of the CSAT is crucial. You should use it after specific moments in the customer journey, like:

The “aha!” moment during the onboarding

Before renewal of the subscription

During the user onboarding and activation flow

After interaction with customer service for a specific issue

After the user has performed an action and reached a predefiend milestone

As with CES, you can always dig deeper to better understand areas of improvement. Running a CSAT survey is a great way to understand how to cultivate customer love.

4. PM Fit Survey (Product-Market Fit)

The product-market fit product survey is a single question survey type designed to figure out if you've achieved product-market fit for a specific user segment. This would mean you have proven your original value hypothesis. You would've proven that you were right about why a user should choose your product or service.

Methodology

With this type, you should only survey recent users (not more than two weeks after they sign up) and those who have used your product or service at least twice. You can take advantage of this product marketing survey also to segment your users more, performing the survey on different segments so that then you can continue with different actions for each of them. The question will be:

How would you feel if you could no longer use [product / service]?

The answers will be among these:

Very disappointed

Somewhat disappointed

Not disappointed (it isn't that useful)

N/A – I no longer use the product

Of course, you shouldn't use customer satisfaction surveys when it's still too early and they haven't had enough time to engage with your product. The results will be good if you end up with 40% or more of “very disappointed” users.

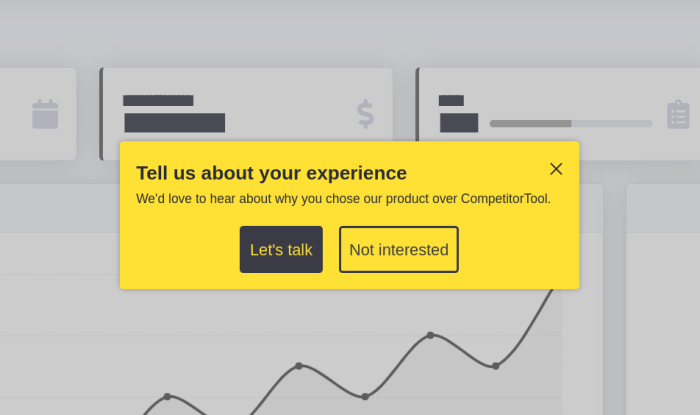

5. Feature opt-in survey

If you are doubting about adding different new features for your product or service, you can always ask how customers feel about them. This way, you can gather valuable feedback from early users and avoid building something people don't want.

By giving customers a choice to opt in, you show that you respect their preferences and want to create a product they love. Plus, it helps you identify which customers are most interested in trying new things.

Using opt-ins can also help you during beta testing. You can focus your testing efforts on people who are genuinely excited about the new feature (more on the beta feedback survey below).

Methodology

A feature opt-in microsurvey is asking your users specific questions about new features or improvements you want to work on.

Make sure you explain the best possible way the feature you're offering them. Explain the benefits by using your value proposition. This survey will help you get to the next phase of your product/service development.

If you have an app that helps users communicate through chat, a feature opt-in survey could be based on asking your users if they'd like to use video calls.

An example of this would be the two-option Microsurvey:

6. Beta feedback survey

Beta testing isn't just about trying things out; it's about listening and learning. If you want to test a product or service while gathering user feedback, the Beta feedback survey should be the one you go for.

Why is it important?

Find problems: see if anything is broken or hard to use

Get ideas: learn what people like and what they want changed

Make it better: use feedback to improve your product before it's finished

You can turn beta testers into your product's biggest fans when you ask the right questions.

Methodology

The usual questions you can ask are related to features, but those are not the only ones you can include. In fact, you should think about three kinds of questions:

Questions related to needs:

Why does the user need to solve the problem?

How has the user tried to solve the problem before?

The idea is to let the user speak freely. These kinds of questions are ideal to identify possible solutions or validate your value hypothesis.

“What are the benefits of this product / service to you?”

Questions related to features:

What does the user dislike?

What does the user like?

What would the user change?

These are questions designed to gather feature analytics and specific requests about features from your users.

“Who else do you think would need/like this feature?”

“How do you use the feature now? What is the workflow?”

Questions related to UX/UI:

What was the first impression the user got about the app?

How difficult was it for the user to understand how to perform an action or how to use a feature?

These questions will allow you to understand if the flow can be improved, also if the layout is optimal to find everything and if the information is clear.

“How difficult was it to upload the files?”

The Beta feedback product survey is great to find bugs, to improve user experience and to get to know better your users' potential needs and desires, while still in the early stage of development.

7. Churn feedback survey

When you are about to lose a customer or you have already lost them, it's advisable to get some feedback, so that you can avoid losing more users or even recover the client that is willing to leave.

To improve your offering you must know the reason why the user is leaving.

Is it due to:

Some other company that's better or newer?

Is the product not efficient enough to solve the user's problem?

Is the subscription meant to target another kind of user?

Does the product present obstacles the user cannot surpass?

The churn feedback product survey is meant to help you with this matter.

Methodology

The questions should be open-ended so that the user can freely express their opinion. However, if you have hints on what the issue could be, you can also present a multiple-choice survey but, make sure to always leave one last option for the user to include comments.

“Why did you decide to quit / uninstall / cancel your subscription?”

I never manage to finish an entire movie.

I could never find a movie I liked.

I don't understand how to use the platform.

I forgot I had the service.

I don't use it enough to justify the fee.

Other (add your comment)

By identifying problematic areas, or types of issues, the churn feedback product survey aims to increase retention metrics and even to attract new users, if you finally improve your solution.

8. "Aha!" moment survey

The "aha!" moment is an emotional positive reaction to the discovery of a feature. It can happen with the first use of the product, or even before trying it. It can also happen after the user has been using the solution for a while.

An "aha!" moment discovery survey is capable of identifying that moment, in which your user recognized the true value of your solution. This means that it will help you find out when (and why) they truly engaged with your brand.

Methodology

This customer survey type is usually designed as a free-form. Formulate the questions based on your value hypotheses. Below is an example.

Deeply understanding the "aha!" moment can lead you to better figure out how to guide new targeted users. It will be the North Star to your company. It will also be good to know if the "aha!" moment is the same for everyone, or if it changes depending on the user.

9. Persona identification survey

The risk of failing to understand your users is big. The Persona Identification in-product survey has the goal of enabling personalization of onboarding experience. In this way, you'll create the best possible experience for each individual, or at least for a specific audience segment.

Getting a Persona identification will help you to better know the behavioral drivers of your clients and their mindset.

Methodology

Open-ended questions will help you frame needs and motivations; 5 to 7 questions is the ideal number for this survey.

Things to consider:

What can the user tell us about themselves?

What are they using the product/service for?

Have they considered another option?

What features will be more important to them?

Here is an example below.

10. Fake door test

The fake door test is a method of market research to prove demand for a new feature or product. Your goal with ths experiment is to measure interest at an early stage (before development) and to get feedback from users that can shape product direction. You will also be learning which is the target audience that shows interest and which CTAs or images work better.

Methodology

You can build an advertisement, button, or even website. It should always be used carefully as it could decrease credibility. When the test has finished, always close with an explanation of your goals and a thank you message. Below is an example.

11. Usability study recruitment survey

Finding people to take part in user research can be tricky. If it's your first usability study and you don't know how to recruit, you should follow this process:

Screen to survey the right type of user

Schedule more users than you will need

Pay the participant users

Methodology

To screen efficiently, you will need a short questionnaire to help select participants who better represent your audience. This will be your product survey for usability study recruitment. Two ideas include:

Email outreach

In product opt-in

In both cases you can feature a way to schedule sessions, capture job titles and other variables to segment feedback. Who do you send this survey to? Well, if you already have current users, take advantage of that.

If you are building your database from scratch, it will depend on your target. Avoid sending it to your personal database or a random volunteer beta tester list.

Make sure to build your sample based on your users' ideal characteristics, behaviors, and attitudes. Using the power of social media advertising could be a good idea to reach your specific target audience. Below is an example.

12. Competitor usability testing survey

To create a truly exceptional product, it's essential to understand your competition. One effective method is competitor usability testing. By observing how people use your competitors' products, you can gain valuable insights into your target audience's mindset and expectations.

You can identify areas where your competitors fall short, uncovering opportunities for your product to excel. Additionally, you can learn about the features and functionalities that resonate with your target market.

Even small improvements based on a competitor analysis can make a huge difference in user experience.

Don't forget to also leave room for users to give you survey feedback. This will help you improve your user research methods or find more suitable user feedback tools the next time around. Below is an example.

Now that we've explored different product survey types and how to implement them. Let's dive into the heart of any successful survey: the questions themselves.

20 Questions to ask in your next product survey

The questions you ask in your survey can make a huge difference in the quality of insights you gather. Well-crafted questions help you understand your customers deeply, while poorly designed ones can lead to misleading results. Consider a mix of multiple-choice, Likert scale, and open-ended questions to gather both quantitative and qualitative data.

Here's a breakdown of 20 product survey questions:

General satisfaction:

How satisfied are you overall with [product name]? (Likert scale)

On a scale of 1 to 10, how likely are you to recommend [product name] to others? (Why or why not?)

In your own words, describe how [product name] has impacted your [area the product benefits] (Open-ended)

Feature exploration:

What is your favorite feature of [product name] and why? (Open-ended)

Imagine you could add one new feature to [product name], what would it be and why? (Open-ended)

If a friend was considering [product type], what would be the top 3 reasons you'd recommend [product name]? (Open-ended)

How easy is it to find the information or functionality you need within [product name]? (Likert scale with optional "Can you elaborate?")

Understanding needs:

What are your primary goals when using [product type]? (Open-ended)

How can [product name] better support you in achieving those goals? (Open-ended)

What are some of the biggest challenges you face when trying to [what the product helps with]? (Open-ended)

How does [product name] compare to other solutions you've tried for this purpose? (Open-ended)

Future focus:

How interested would you be in participating in a beta testing program for new features in [product name]? (Multiple choice)

Imagine [product name] existed 5 years from now; what features or functionalities would make it even better for you? (Open-ended)

Is there anything else you'd like to tell us about your experience with [product name] or how we can improve? (Open-ended)

Engagement and usability:

How often do you use [product name]? (Multiple choice)

Have you encountered any bugs or usability issues while using [product name]? (Yes/No with optional "Please describe")

Customer Support:

How easy was it to find the information you needed on our customer support website or knowledge base? (Likert scale)

How long did it take you to connect with a customer support representative? (Open-ended)

Did the customer support representative answer your question clearly and thoroughly? (Yes/No with optional "Why or why not?")

How satisfied were you with the resolution you received from customer support? (Likert scale)

You've carefully crafted your survey questions. Now, it's time to optimize your survey design and delivery for maximum impact. Here are some best practices so your survey gets the attention it deserves and provides valuable insights.

8 best practices with real-world Product survey examples

Here are some tips to craft killer product surveys that give you the info you need to make your product even more awesome.

1. Keep surveys short and focused (Respect your users' time)

People are busy. As a general rule of thumb aim for a survey that can be completed in 5-10 minutes. A lengthy survey risks lower completion rates and less reliable data due to fatigue. For example, Airbnb's post-stay surveys typically contain just 3-5 questions about the guest's experience.

2. Use a mix of question types (Get a variety of perspectives)

Balance multiple-choice for ease of response with open-ended questions to gather in-depth user experiences and opinions. Consider using Likert scales for satisfaction ratings. For example, Uber uses a 5-star rating system along with optional comments in their post-ride surveys.

3. Time surveys appropriately (know what you're looking for!)

Send surveys at relevant moments in the customer journey. For example, after users interact with search results in Gmail, Google Workspace prompts them with a survey to understand their awareness and experience with the feature.

4. Prioritize for mobile (Reach users on their preferred devices)

Ensure your survey is mobile-friendly to accommodate users who prefer to complete surveys on their smartphones or tablets. A responsive design and easy navigation are essential for a positive mobile experience.

Amazon has a dedicated mobile app called the Amazon Shopper Panel, which is an invitation-only program where participants can earn monthly rewards by completing short surveys, among other activities. This app is designed to be mobile-friendly, making it easy for users to participate in surveys on their smartphones.

5. Offer incentives for participation (Sweeten the deal!)

Offering a small incentive like a discount or entry into a prize draw can encourage users to complete your survey. Starbucks sometimes partners with platforms like Qwoted to offer gift cards for completing surveys and using the platforms.

7. Test surveys before launching (Catch any snags before launch)

Before launch, test your survey with a small group to identify any confusing questions or illogical flows. This ensures a smooth experience for your target audience.

Google also follows a similar approach, but it does not have dedicated QA or tester roles. Google uses a concept called "Test Certified" levels, which defines different levels of testing maturity for projects. Higher levels require more comprehensive test coverage and practices.

8. Analyze and act on results (Don't let the data gather dust!)

Don't just collect data, put it to use! Analyze the results to identify trends and actionable insights. Use these insights to improve your product, marketing, or customer support. Trello has a public roadmap where they update users on the status of requested features, showing that they value and act on user feedback.

Fuel product growth with product survey feedback

A continuous collection of user feedback is one of the best strategies your product team can use to drive product growth. Using various customer survey types and user feedback tools to run contextual in-product surveys can be a significant addition to your product and UX tweaks, iterations, and improvements.

The type of product survey will depend on your needs and goals you want to achieve. With the 12 survey types we outlined here, there are plenty of choices for you to start.

Once you decide which survey type to use, the next steps will include segmenting users, choosing the right type of questions, designing surveys to drive more engagement, and then analyzing data, evaluating results, and identifying areas for improvement.

Remember, every survey is an opportunity to create a product that people love.

Run product surveys with Chameleon

In-app Microsurveys allow you to capture important user feedback when it's most relevant